Entrusted for 30 years with the financial well-being of thousands of successful Australians, Required has ensured that all of them enjoy the bright and prosperous future that they deserve.

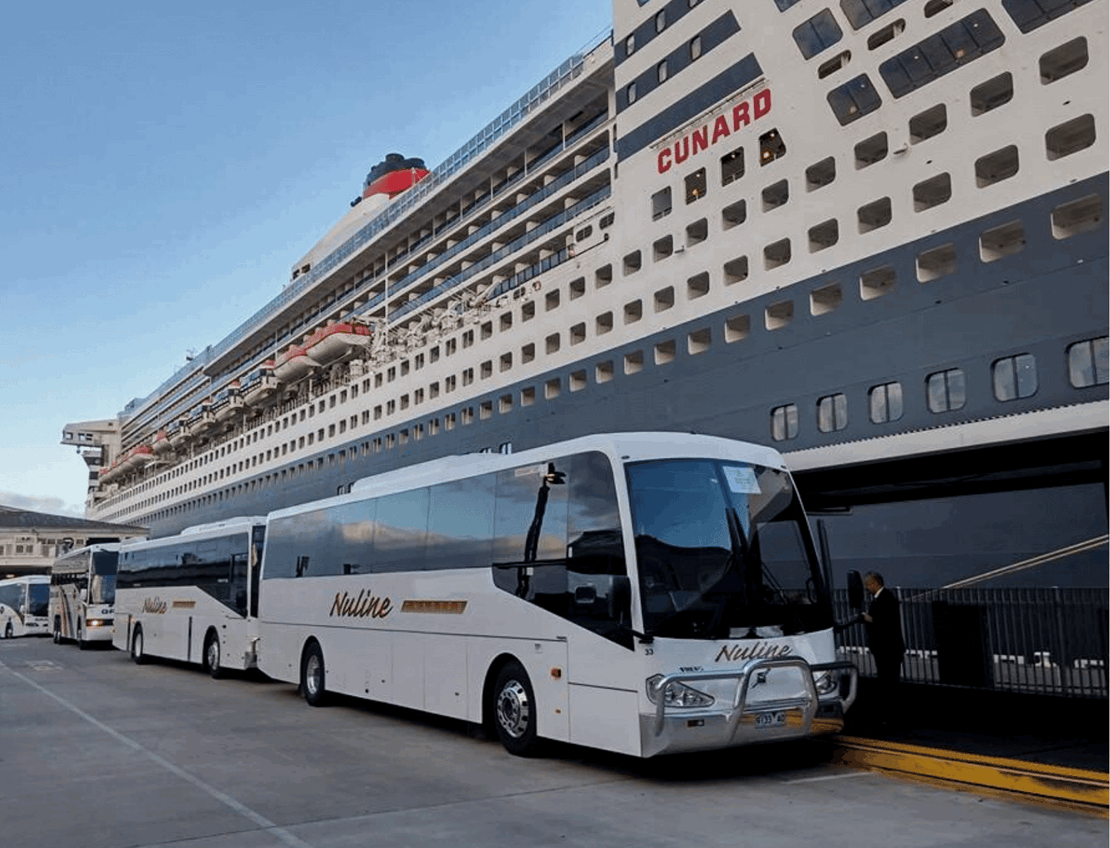

You deserve the finer things in life...the peace of knowing your family is cared for and secure, the thrill of cruising the world while savouring exotic cuisine, and the joy of driving cars that revel in every journey.

Required Financial Services is committed to turning these dreams into reality.

WEALTH

PROTECTION

ADVICE

We build your WEALTH

Our financial planning and investment options will help build passive income and long-term wealth.

Put your money to work for you and build your wealth passively.

We PROTECT your assets

Give yourself peace of mind with life insurance and income protection plans to weather any setback.

We will help you set up an education plan to ensure your children's future and a savings and retirement plan for yourselves.

Solid Financial ADVICE

We guide your situation on the best course for accomplishing your financial goals which may include Self-Managed Superannuation Fund, Insurance advice, Pension advise, Cashflow planning, Mortgage loan advice, along with other financial advice needs.